Zensurance Small Business Insights

News and resources for Canadian small businesses and startups covering the economic and business insurance landscape.

Recent posts

What Type of Insurance Does Your Pool Cleaning Business Need?

As the warm weather returns, Canadian swimming pool owners will open their watering holes to escape the heat. They trust and rely on professional pool cleaners for their expertise, but is your pool cleaning business ready for the season ahead? Here’s what you should know.

Survey: A Shocking Majority of Canadians Would Sue a Small Business

A new survey of Canadian consumers finds the legal risks confronting small business owners are on the rise, potentially threatening self-employed professionals' and business owners’ financial well-being. Here’s how you can protect your business.

4 Common Handyman Insurance Claims

No skilled tradesperson is immune from accidents, making mistakes, or experiencing unexpected damage or loss. Here are four claims handypersons typically face and how insurance helps protect their finances.

Liquor Liability Insurance vs Host Liquor Liability Insurance: What’s the Difference?

Understanding the distinct differences between liquor liability insurance and host liquor liability insurance is crucial for business owners and hosts alike. Let's explore the unique coverage offered by each, shining light on the importance of securing the right protection for your specific needs.

10 Ways to Prevent Shoplifting in Your Retail Store

An estimated 57% of Canadian small businesses dealt with theft or shoplifting in 2023. See our tips on how to spot possible shoplifters and the things you can do to prevent shoplifting and theft of your merchandise.

What Type of Insurance Does a Doula Need?

Doulas do not perform clinical tasks, diagnose medical conditions, or give medical advice, but they do support women throughout their pregnancies. However, with that responsibility come liability risks that should be covered by insurance. Here's what every doula needs to know.

Small Business Tips

Women in Insurance – Breaking the Cycle of Underrepresentation

Of the top fifteen insurance companies in Canada, only 33% of CEOs are women. This statistic reflects a startling trend

Liability Insurance For Retailers: Holiday Edition

The holiday season isn't all sleigh-bells and sugar plums for retail shop owners. Sure, you will probably experience increased profits,

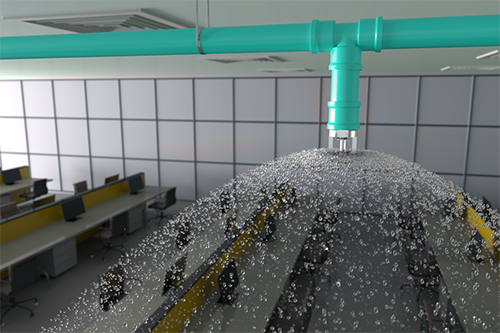

Ontario Business Insurance for Remote Businesses

Being your own boss allows for many cool business opportunities, one of which is the ability to run your

Insurance

Insurance Considerations for E-Commerce Businesses During the Holidays

With the busiest shopping season of the year underway, online retailers and e-commerce businesses need to be vigilant to prevent data breaches and cyber-attacks and get coverage for customer injuries. Here’s how insurance can help.

Contractors: Are You Insured for Installing Christmas Lights for Your Customers?

Offering holiday light installation is a great service to offer your customers – but is your business properly insured for the risks involved? Here’s why you need to be covered.

When Does a Holiday Gift Become a Tool of Your Trade?

It’s wise to talk to your broker and ask for an annual review of your policy as your business grows. Regardless of your profession, don’t forget to protect any new items you receive this holiday season you will use to do your job.