Zensurance Small Business Insights

News and resources for Canadian small businesses and startups covering the economic and business insurance landscape.

Recent posts

Renovating Your Business? Here’s Why You Need to Cover Renovations

Undertaking any commercial renovation project requires a significant investment. A common mistake many business owners make is overlooking the need to insure the renovations. Neglecting to do so can be costly. Here’s how insurance can help cover your building’s makeover.

11 Reasons Why a Business Insurance Claim Could Be Denied

Sometimes, an insurance company may deny a claim. Here are 11 common reasons why that can happen and what to do if it happens to your small business.

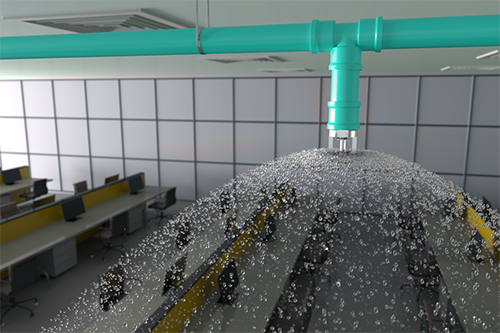

10 Business Insurance Claims We Saw in 2023

For some professionals or business owners, buying business insurance is a legal or regulatory requirement. For others, it is not. Either way, it’s wise to do so. Here are 10 real-life reasons why you should.

Will the Bank of Canada Cut Interest Rates in 2024?

The Canadian central bank’s first interest rate decision and announcement of 2024 is hotly anticipated. Will the Bank of Canada announce an interest rate hike, cut, or will it hold its rate steady? Here’s how each possibility may affect small businesses.

What Is Commercial Crime Insurance?

According to data, 75% of employees admit to stealing from their workplaces at least once, and 64% of small business employees pinch or lift funds from their employers. That’s costing Canadian businesses between $1.4 billion and $2 billion annually. Here’s how insurance can help.

Do You Need Business Insurance for Your Side Hustle?

Surviving in a tight economy or increasing your income requires more than launching a side hustle. It also requires protecting your finances. Here's how you can do that.

Small Business Tips

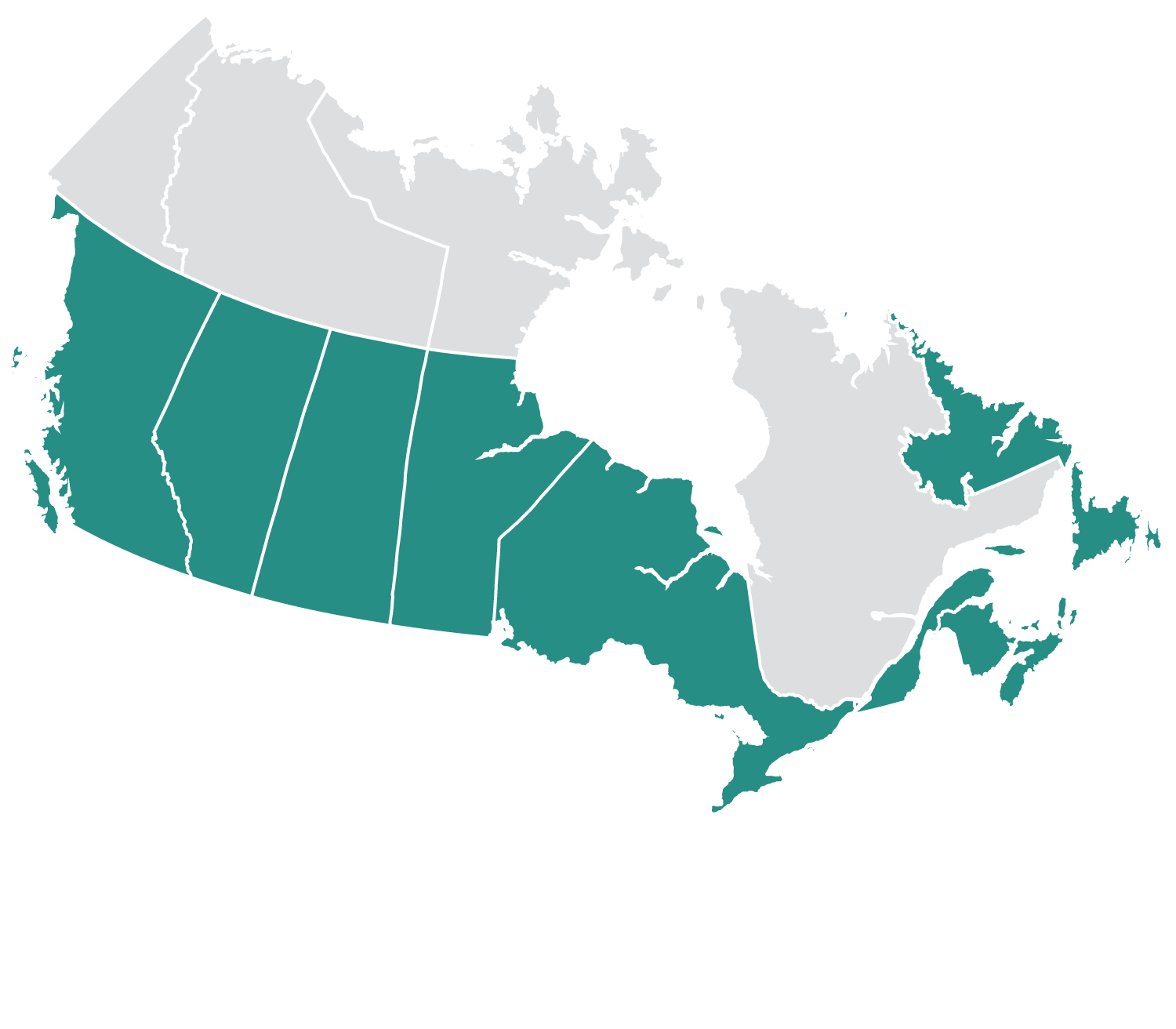

Business Insurance Company Zensurance Expands to a Ninth Canadian Province

From British Columbia to Newfoundland, Zensurance makes business insurance an easy process for Canadian entrepreneurs.

Errors & Omissions (E&O) – Claims Examples

Errors & Omissions Insurance (E&O) is a useful policy that can protect you in case you make a

What Does General Liability Insurance Mean For a Restaurant Owner

If you’re a restaurant owner, you’re familiar with the following scenario—a drink spills, a server is walking

Insurance

Understanding Business Interruption Insurance Before Winter Hits

Winter weather can force you to close for a few days (or worse) unexpectedly. That’s why now’s the time to give business interruption insurance thought. Here are your options and how business interruption coverage can protect your income if forced to close temporarily.

What Type of Insurance Does a Hairstylist Need?

Stylists are not immune to making mistakes, accidentally injuring customers, or a salon or barber shop being damaged by fire, water, or a break-in. Here’s how hairstylists can protect their finances, business contents, and careers.

Business Liability: What You Need to Know Before Hosting Fall Events

Hosting an event or gathering this fall to increase your sales? Check your liability insurance coverage to ensure it adequately covers your risks. You might need special event insurance to safeguard your finances. Here’s what to know.