Zensurance Small Business Insights

News and resources for Canadian small businesses and startups covering the economic and business insurance landscape.

Recent posts

Do You Need D&O Insurance or E&O Insurance?

Both directors and officers (D&O) insurance and errors and omissions (E&O) insurance provide liability protection, but they address distinct risks. Choosing the wrong one could leave critical gaps in your coverage. Here’s what every business owner should know.

Starting a Food Truck Business? Here’s What You Should Know

Thinking about hitting the streets with your own food truck? Learn exactly what it takes – from writing a solid business plan to handling startup costs, permits, and insurance. See our tips to fuel your success and steer clear of common mistakes.

How to Use ChatGPT to Grow Your Business

Explore our guide for Canadian small business owners new to artificial intelligence (AI) to learn how to utilize ChatGPT to streamline operations, boost productivity, and reduce operational costs.

Do Life Coaches Need Liability Insurance?

Get an overview of how liability insurance for life coaches can protect their finances and reputations against client claims and allegations of wrongdoing, lawsuits, accidental injuries, cyber risks, and property damage.

10 Common Warehouse Risks and How to Reduce Them

Handling the cost and impact of accidents and being prepared for unexpected damage and loss caused by events beyond their control is a top challenge for warehouse owners. Get an overview of the most common warehouse hazards and how insurance can protect your business.

8 Insurance Risks Gyms and Fitness Centres Face

Even the most organized and well-managed gyms and fitness centres are vulnerable to many liability exposures. Learn about the 8 most common liability risks gym owners face and how customized insurance protects their finances.

Small Business Tips

7 Inexpensive Tools for Small Businesses to Create Videos

Using videos to market your business can be a game-changer. For small business owners and self-employed professionals on tight budgets, see our list of options for creating engaging videos with minimal effort and cost.

Preparing Your Business Vehicle for Autumn and Winter

Driving in dark, slick, or wintry conditions can be more demanding than driving in the summertime. See our safe driving tips and recommendations for preparing your vehicle for the colder temperatures before the weather turns.

How to Write a Snow Removal Contract

Gearing up for the winter and inking customers to your snow removal contracts should be in full swing well before the chilly weather descends. See our tips for things your snow removal contracts may need to include for commercial and residential properties.

Insurance

7 Online Retailer Risks in Canada Liability Insurance Can Cover

Canadian e-commerce businesses face increasing liability threats, including cybercrime, product lawsuits, fraud, and reputational damage. Find out what common liability risks online businesses face and how liability insurance can help when things go wrong.

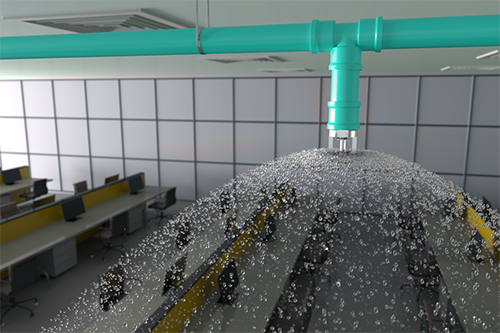

Fire Prevention Week 2025: How to Protect Your Small Business From Fires

October 5 to 11 is Fire Prevention Week in Canada. See our tips and resources for minimizing the risk of fire on your commercial property and how business insurance can help your company recover following a fire.

What Small Businesses Need to Know About Cyber Insurance

Data shows that 62% of Canadian small businesses don’t consider cybersecurity a financial priority, and only 18% have cyber insurance. Here’s why those small businesses need to get serious about cybersecurity.

Financial Business Tips

Cybersecurity

Startup Tips

How to Start an Instagram Business

More than 33 million Canadians use social media networks regularly, and Instagram ranks as the second-most popular. Here’s how you can get started and use the photo- and video-sharing site to grow your small business.

How to Start a Photography Business

Your primary motivation to start a photography business isn’t to be a business owner necessarily. It’s to take high-quality photos and make a living off them. Read our guide on what to do to launch your photography career.

How to Start a Cleaning Business (and Mop Up the Competition)

Striking out on your own by launching a cleaning business? With workplace and residential hygiene and safety being top-of-mind, now may be the time to kickstart your dream into reality. Here are five steps to take to get your cleaning business up and running.