A certificate of insurance (COI), or proof of insurance certificate, summarizes your business insurance coverage and proves your business has liability insurance.

It’s a document issued to a policyholder by an insurance company or broker that confirms your policy is active and outlines the coverages you have, the policy’s coverage limits, its expiration date, and other key information.

Every small business owner, entrepreneur, independent contractor, or self-employed professional, regardless of their field, needs a certificate of insurance for various reasons.

If you don’t have a certificate of insurance, you could miss out on valuable opportunities.

Many customers – whether large companies or individual homeowners – want assurance that you’re covered in case something goes wrong.

A certificate of insurance shows you have business insurance, giving your clients a sense of security that they won’t be left footing the bill for accidents, property damage, or poor work. You may find it hard to earn their trust or business without it.

What Information Does a Certificate of Insurance (COI) Have?

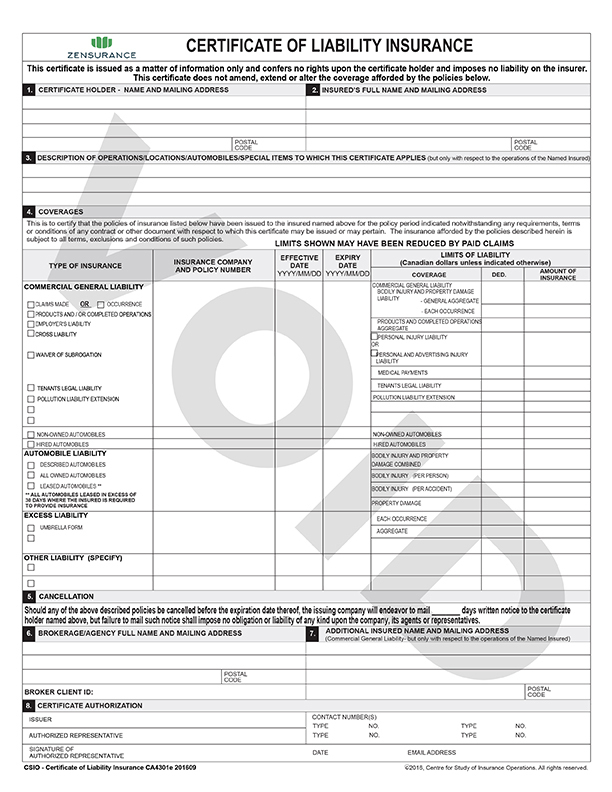

Your licensed Zensurance broker can quickly provide a COI after purchasing a policy. A typical COI includes the following information:

- The broker’s details: The name of the broker who issued the COI, their address, and phone number.

- The insurer’s details: The name of the insurance company underwriting the policy.

- The business’s details: The policyholder’s name, business name, and address.

- Additional insureds: The names of individuals or organizations named as additional insureds on the policy.

- The policy’s details: The insurance policy number, its expiration date, the coverages in the policy, the business operations to which the policy applies, the coverage or policy limits, exclusions, and deductibles.

Related Posts

Sign Up for ZenMail

"*" indicates required fields

Why Do Businesses Need a Certificate of Insurance (COI)?

There are many reasons why business owners need a certificate of insurance, such as:

- A general contractor needs a COI when submitting a proposal or bidding on a contract to a partner or customer to do work for them.

- An entrepreneur or business owner seeks a loan from a financial institution.

- An event organizer or business that hosts an event at a rented venue must verify that they’re insured with the property owner.

- A retailer seeking to rent or lease a commercial property to show the landlord they’re covered.

A COI can give a business or professional an edge while vying to win a contract or new business.

In essence, it’s proof that you can cover the cost of a liability claim should the unexpected happen where an employee, customer, or another entity gets hurt or suffers a financial loss because of what you do or your company’s operations.

What Kinds of Small Businesses or Self-Employed Professionals Need a Certificate of Insurance?

Whether you are an independent contractor, a caterer, or an accountant who manages finances for other businesses or individuals, it is wise to have a COI on hand to provide any partners or customers upon request.

It comes down to your and your customers’ needs. In general, any small business or independent professional providing a service with the potential for liability losses may be asked to provide a COI.

Also, if you request to see a COI from a third party, it’s worthwhile to contact the brokerage that issued the document to verify that all the details are correct and the policy is valid.

Is a Certificate of Insurance the Same as a Business Insurance Policy?

No, a COI differs from a formal business insurance contract between you and an insurance company.

A COI is a one-page document that proves you are insured should you need to provide it to a partner, customer, or financial institution.

On the other hand, a business insurance policy clearly defines your coverages, the business operations to which the policy applies, the coverage limits, exclusions, deductibles, endorsements, and the policy’s conditions.

It outlines the coverage specifics and terms governing the relationship between your business and an insurer.

Do You Have the Right Type of Insurance to Protect Your Small Business?

Business insurance policies are typically one-year contracts between business owners and insurance companies. They must be renewed annually to ensure continuous coverage.

But a lot can change in 12 months. That’s why it’s vital to work with a licensed insurance broker who can serve as your trusted advisor, review your liability risks and existing coverage, recommend ways to enhance your coverage if necessary and reduce the liability risks you may face.

Getting Insured Is Quick and Easy With Zensurance

Whether your policy is due for renewal, you’re considering switching to another insurance provider, or you’re seeking a small business insurance policy for the first time, get a free quote from Zensurance.

Fill out our online application for a free quote in five minutes or less.

Our friendly broker team strives to find our customers the low-cost protection they need from our partner network of over 50 insurance providers, answer questions, and customize policies to suit your requirements and budget.

– Updated June 27, 2025.

Download Our FREE Insurance Guide

Learn everything you need to protect your small business.

Whitepaper download

"*" indicates required fields

Your email address will be used by Zensurance to provide latest news, offers and tips.

You can unsubscribe at any time.

Recent Posts

What Is a Certificate of Insurance (COI)?

A certificate of insurance (COI), or proof of insurance certificate, summarizes your business insurance coverage and proves your business has liability insurance. Without it, you could be missing out on many opportunities. Here’s what every business owner should know.

What Type of Insurance Does a Home-Based Bakery Need?

Countless Canadian bakers with a flare for making scrumptious baked goods are always in high demand, prompting many to start a home-based bakery. But there’s one essential ingredient they should never skip – liability insurance.

Contractor vs Subcontractor: Understanding Liability and Insurance

It can be confusing to understand the specific risks contractors and subcontractors face during construction projects. Get a straightforward understanding of what's at stake and the types of insurance these professionals require.