Selling goods and services online is not new. But it appears the COVID-19 pandemic drove Canadian small business owners and independent sellers to increasingly tap into digital marketplaces such as Amazon, Wayfair, and Etsy.

Statistics Canada notes many small businesses shifted their sales operations online at the height of the pandemic. About one in 10 small businesses with one to four employees (10.7%), five to 19 employees (9%), and 20 to 99 employees (9.7%) made 50% or more of their total sales online in 2020. By comparison, in 2019, 7.8% of small businesses with one to four employees, 4.9% of businesses with five to 19 employees, and 6.7% of businesses with 20 to 99 employees made 50% or more of their total sales online.

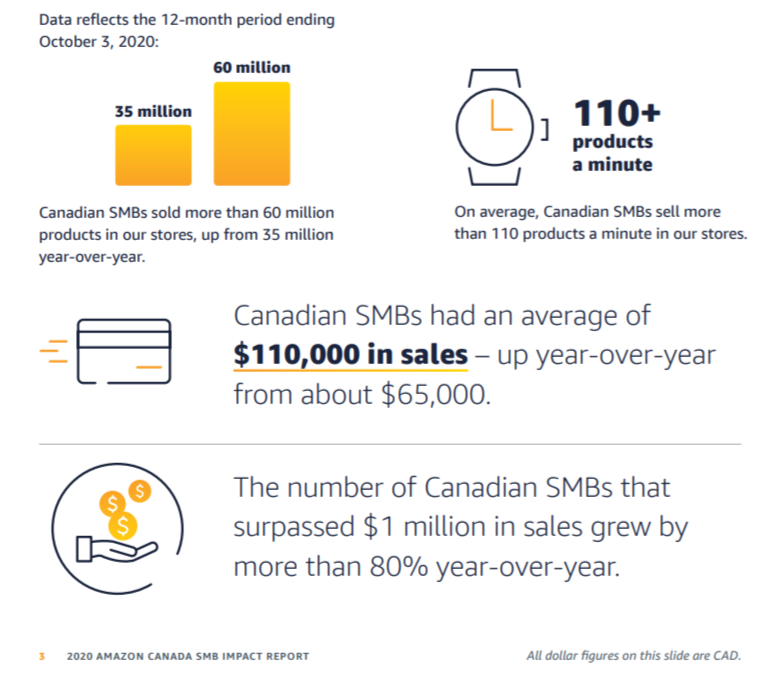

Moreover, according to the “2020 Amazon Canada SMB Impact” report, which zeros in on Canadian small and medium-sized businesses (SMBs) that are Amazon sellers, there were 30,000 third-party sellers actively selling on the digital marketplace, grossing more than $1 billion in 2019. That’s a remarkable 40% year-over-year increase. Moreover, Canadian Amazon sellers earned an average of $110,000 in sales, up from $65,000 one year earlier, and the number of them that surpassed $1 million in sales grew by more than 80% year-over-year.

That’s impressive. But so too are the risks associated for independent sellers and small businesses with selling and distributing products through any digital marketplace. Essentially, any small business is potentially liable for injuries, illnesses, or property damage a customer experiences from the item they purchased from you. That includes products you did not design or manufacture.

Canadian Consumers Increasingly Flocking to Amazon

The Toronto Star reports Canadian consumers spend around $9.4 billion annually on Amazon, making it one of Canada’s largest retailers. And though Amazon enacted new policies on September 1, 2021, requiring Canadian Amazon sellers who earn $10,000 in monthly sales to carry liability insurance, many business owners and independent sellers may not be aware of how a third-party lawsuit could be financially ruinous. However, a comprehensive business insurance package for digital marketplace sellers can help manage your liability risks and cover you from an unexpected problem such as a lawsuit.

“Obtaining insurance coverage for your business is not only becoming more of a requirement, but also a wiser business decision. Insurance coverage gives you that piece of mind that in the event of a loss, your policy can cover you per the terms of the policy. Without insurance in place it creates further risk exposure that can have a significant impact on your financial statements and company growth,” explains Shaan Alikhan, Team Leader, New Business, Property and Hospitality, Zensurance. “A single loss can take you out of business. Why take that risk, when you can cover yourself for up to millions of dollars, for a much lower cost? You want to generate more revenue, and we want to protect you so that can happen.”

How to Protect Yourself and Your Online Business

There are several liability coverage options available for small businesses and independent digital marketplace sellers. But, at a minimum, it’s wise to have a commercial general liability (CGL) insurance policy in place. That’s because a CGL policy, which includes product liability coverage, is designed to protect business owners against lawsuits claiming third-party bodily injury and property damage resulting from any product you sell online.

But CGL and other business insurance coverages are not limited to Amazon sellers. For example, if you sell goods on Wayfair, Wayfair requires you to have CGL insurance with $2 million worth of coverage.

Furthermore, sole proprietors can also be insured against these types of risks. It’s not restricted to corporations. Independent marketplace sellers who sell products online as a side hustle or hobby face the same liability risks as larger organizations.

“When you start a business, regardless if it is part-time, full-time or even just a hobby, purchasing insurance coverage is one of the most important business decisions you will make. With Amazon implying new insurance requirements for sellers online, it is important for you to obtain a substantial amount of coverage to meet these requirements in order to operate your online business,” Alikhan says. “Businesses selling products online can be charged different rates based on the products being sold and the risk exposure behind these products. With this noted, and keeping in mind your products can be sold all over Amazon, there is a lot of liability exposure on you and your business — for this you need insurance coverage.”

Lookling for insurance for your online business?

Let’s get started with your online application to get your free business insurance quote.

5 Online Selling Tips for Small Businesses

Whether you’re new to or experienced selling products online, here are five tips to help your company stand out in any highly competitive digital marketplace:

- Know your customers. Understanding who you are selling to will help you define how your products will benefit your customers and how to market to them.

- Have a unique selling proposition. What makes your business special? Why should a consumer purchase the products you offer? Determining what your unique selling proposition is can help you stand out from other businesses. But it’s not necessarily what you’re selling that makes your business unique. The story you have to tell and the messaging you choose helps define you from your competitors.

- Use digital marketing. Publishing fact-filled blogs consistently that add value to your customers’ experience, engaging with your audience through social media, and leveraging search engine optimization (SEO) best practices can increase your visibility online.

- Be cyber smart. An estimated 93% of Canadian consumers are highly concerned about cyber-attacks on the organizations they share their data with, and 78% worry that their data may be stolen in a cyber-attack. Any company with an online presence is a potential target for hackers. Adhering to cyber security best practices and protecting yourself with cyber liability insurance is essential to lowering the risks you face.

- Have a profitability strategy. Every online business needs to make money, or it won’t last long. Establish a realistic plan focused on profitability, operational costs, and attempt to forecast your revenue growth and expenses. An effective profit strategy is a management tool to evaluate your operating results and actions plans.

Recent Posts

What Type of Insurance Does a House Cleaner in Canada Need? (Coverage Explained)

House cleaners provide an essential service to Canadian households, but even small accidents can lead to costly claims. Here’s the insurance coverage professional house cleaners in Canada need to protect their businesses and income.

What Is Hired and Non-Owned Commercial Auto Insurance?

If your business rents or leases vehicles, or if employees use their own cars for work, hired and non-owned commercial auto insurance can help protect your business from costly accidents and liability claims. Here’s what Canadian business owners need to know.

What Is a Deductible in Small Business Insurance? (Definition, Examples & How It Works)

A deductible is the amount your small business pays out of pocket when you file an insurance claim. Understanding how deductibles work can help you lower premiums, avoid surprises, and choose the right coverage.