Partnerships with over 50 leading Canadian insurance providers

Insurance for chiropractors

More and more people realize the positive impacts of natural alternatives to deal with chronic pains. Therefore, chiropractors are in huge demand right now. And while chiropractors are advocates for wellness, there’s always a chance things won’t always go well. When your business includes hands-on alignment of patients, there is always an element of risk involved.

As a chiropractor, you have unique risks to consider, and we’re here to help protect you. Zensurance has helped over 100,000 entrepreneurs protect their businesses with insurance policies that are right for them.

We’re on a mission to make insurance easy to understand and be transparent about the correct coverage details. Below, we answer the top questions about chiropractor malpractice insurance.

Common claims scenarios

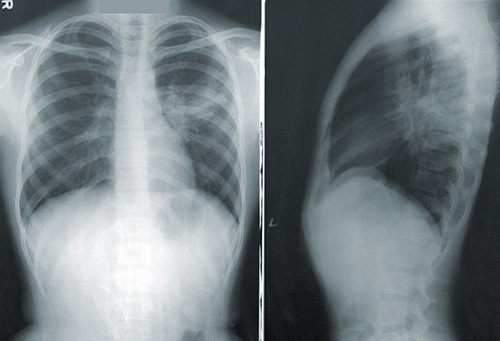

Problem: Your patient’s spinal x-ray showed signs of scoliosis, so you recommend specific alignment for treatment. A few weeks later, you realize the x-ray matched with the wrong patient information, and your patient’s x-ray shows there were no serious issues. Your patient sues you for negligence.

Outcome: Your Professional Liability Insurance policy could cover the legal fees for the misdiagnosis claim, totalling $30,000.

Problem: You’ve added some children’s toys to your waiting room. One morning, a child falls off an unstable rocking horse and injures themself.

Outcome: The child’s mother successfully sues you for the injury. Your Commercial General Liability Insurance policy could cover the legal expenses and medical fees, totalling $10,000.

Problem: You’re performing a routine adjustment on a patient. Unfortunately, you provide too much pressure during a specific alignment and cause severe injury to their back. Your patient sues you for malpractice.

Outcome: Your Malpractice Insurance policy could cover any medical expenses and legal fees totalling $50,000.

Frequently asked questions

Why choose Zensurance?

Intuitive Online Experience

Do everything online, at your

convenience

Always Here For You

We’re just a click away

Full Transparency

Get only the coverage you need in clear language

Our Most Recent Reviews

See what our small business customers have to say about us.

Ready to start? Let’s get a quote!

You’ve built your professional career around the wellness of others; you deserve a broker you can rely on to help you look after the wellness of your business.

Get started today by completing our 5-minute online application form for a free chiropractor insurance quote.

If you need more information or prefer to speak with a broker, our friendly team will always help guide you through the process.