Partnerships with over 50 leading Canadian insurance providers

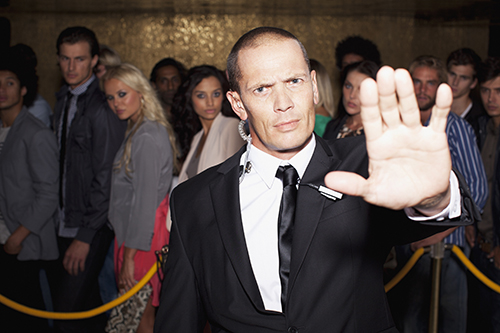

Insurance for security guards and companies

Security guards are conscientious, detail-focused professionals who possess the skills and experience to solve problems efficiently, observe and monitor the properties they are entrusted to protect, and serve with honesty and integrity.

However, security personnel also need protection from the hazards and risks they face in their line of work. A comprehensive security service insurance policy is essential to addressing those challenges.

Common claims scenarios

Problem: One of your bouncers working at a nightclub oversteps their authority and injures a customer they are trying to eject from the premises. The customer sues you for third-party bodily injuries.

Outcome: Your commercial general liability coverage may pay for your customer’s medical expenses as well as your legal defence costs and the outcome of the lawsuit.

Problem: A security guard at a retirement complex falls asleep during the night shift, and a burglar robs a resident. The resident and retirement complex company sues your security firm for failing to deliver a service as promised.

Outcome: Your professional liability coverage may pay your legal defence fees including retaining a lawyer to represent you in court, as well as the outcome of the lawsuit.

Problem: An employee at your executive protection company inadvertently leaks confidential information online on one of your high-profile clients, putting them at risk. The client sues your company for damages.

Outcome: Your cyber liability coverage may cover the costs associated with obtaining legal advice to defend yourself in court and monitoring credit and identity theft for your client.

Frequently asked questions

Why choose Zensurance?

Intuitive Online Experience

Do everything online, at your

convenience

Always Here For You

We’re just a click away

Full Transparency

Get only the coverage you need in clear language

Our most recent reviews

See what our small business customers have to say about us.

Ready to start? Let’s get a quote!

Getting security business insurance shouldn’t be complicated!

Fill out an application to get a free quote from Zensurance. With more than 50 insurance providers in our network, we can get the coverage you need to cover your assets and serve your customers with confidence.